For only the second time I have felt it worthwhile to seek permission from someone to reprint an article. In this instance the author is the well known F1 journalist/business analyst, Christian Sylt. He, along with Caroline Reid produce the annual definitive guide to the business of Formula 1: The Formula One Report which is aimed at the movers and shakers of the business - the sponsors, potential sponsors, teams, media, and all the other players who need to understand the finances of the sport. They also provide a PDF update called the ROI review after every race which, after reading their sample edition from the 2011 Australian GP, is enough to make a die-hard fan go weak at the knees. Just have a look and see.

It's also worth pointing out that Christian, in conjunction with one of the biggest motorsport photography agencies, Sutton Images, is behind the launch of Zoom, the well-publicised "Formula 1 from behind the lens" charity auction to raise money for Great Ormond Street Children's Hospital which will auction off 50 signed photographs taken by the F1 drivers and team Principals.

The following article encapsulates the source of F1 financing. I have reprinted it in its entirety, with the permission of the author, and the ownership and copyright of the work remains with Christian Sylt.

"The only aspect of Formula One which most fans get to see is the cars going round the track - but behind the scenes a complex network of relationships and agreements is in place to literally get the show on the road.

The first race of the World Championship took place in 1950, but it shared few similarities with the present day spectacle which is F1. Almost all the differences are down to the commercialisation of the sport: it has affected the teams’ facilities, the calibre of the drivers, the style of the cars, circuit facilities, television exposure and the number of brands involved with the sport.

The catalyst for such rampant commercialisation was the signing in 1981 of the first Concorde Agreement, the contract which binds the teams, F1’s rights-holders and its governing body the FIA. It commits the teams to race and F1 has been commercialised around them.

According to Formula Money, sponsorship brings in around 48 per cent of teams’ revenue with prize money providing the bulk of the remainder. Both are dependent on television exposure. Since the signing of the first Concorde Agreement, F1’s rights-holders have committed to keeping grands prix on free-to-air television: this has been a master-stroke, driving the sport's average TV audience up to 515 million - making it the most-watched sporting event in the world over the course of a year.

Coming full circle, F1 has established such a dominant position that it is now doing deals with subscription channels such as Sky Sports in the UK and Sky Italia in Italy. Despite having a seemingly unconquerable position, F1 has retained some degree of free-to-air coverage in these markets.

There is good reason for this: the high TV audience allows teams to charge top dollar for sponsorship. Generally speaking, the rear wing, air intake box and side-pods of the car are prime logo positions and a sponsorship deal with a top team involving any one of these locations is likely to cost around £13 million annually. At the lower end of the spectrum small logos are often found on the bottom of the sidepods or on the nose and these can generally be bought for under £3 million per year with a high-ranking team.

Having 515 million viewers makes F1 extremely attractive for broadcasters so they too pay top dollar to broadcast the sport. In turn those TV stations which take advertising get money back from the companies which want to promote their products to F1’s captive audience during the commercial breaks - with the exception of the BBC.

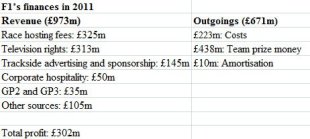

The fees from TV stations are one of the three biggest sources of revenue for the F1 Group which runs the sport. TV rights payments came to £313 million last year and were second only to race hosting fees. Although they are F1’s biggest revenue source, contributing a total of £325 million last year, it is not possible simply to add more grands prix since the Concorde Agreement caps the number at 20 annually and it has hit the ceiling this year with the return of the United States Grand Prix.

Instead of increasing the limit on the number of races, F1 supremos Bernie Ecclestone has implemented a savvy strategy of marketing the sport to emerging nations who want to put themselves on the global map. Hosting an F1 race puts a country on a calendar containing exotic and well-developed nations such as Australia, Malaysia, Japan and Monaco. It also gives promotion to the sport’s massive TV audience.

Since the governments of these countries can use F1 to promote tourism they fund the hosting fees for their race and this has driven up the price to an average of £17 million per race. In 2010 South Korea joined the calendar, last year India came on board and in 2014 the first F1 race in Russia is due to take place.

In addition to the government funding, ticket sales cover the cost of running the races and, according to Formula Money, 3.4 million spectators attended them last year.

Trackside advertising and sponsorship is F1’s third main revenue source. Brands pay for huge billboards beside the track and they are usually grouped to maximise exposure. It creates what are known as ‘themed corners’ which are dominated by numerous identical billboards from one specific advertiser. Again, the huge number of TV viewers makes trackside advertising highly attractive and there is always the chance that cars will smash into them which brings additional media exposure to the brand.

F1 also has a portfolio of nine official partners including technology company LG and logistics firm DHL. They get the right to be the exclusive service provider to F1 in their business sector as well as a range of promotional benefits such as being able to use the F1 logo in advertising. Together, trackside advertising and sponsorship brought in £145 million last year taking F1’s revenue from the top three sources to just over £780 million. It makes an additional £190 million from other sources giving the sport an annual total revenue of £973 million.

The most significant of the other sources of revenue is corporate hospitality which is used by teams and sponsors to entertain clients. Teams get a certain number of complimentary hospitality passes but they can buy more, as can the general public. With the cheapest ticket this year costing £2,215 it certainly isn’t a mass market product but it does make a valuable revenue stream which brought in a total of £50 million last year.

F1’s £973 million revenue isn’t going in the pocket of the sport’s boss Bernie Ecclestone. He receives a £3.3 million salary and owns a 5.3% stake in F1 but as it didn’t pay out any of its profits last year he didn’t get an additional payment. The revenue is used to cover the sport’s running costs which range from transporting hospitality equipment to paying TV cameramen.

The top 10 teams share 47.5% of F1’s profit after paying these costs with a further 2.5% going specifically to Ferrari in return for being the oldest team in the sport. In total, the teams got £438 million last year leaving F1 with a £302 million profit which it used to pay down its debts with the rest – around £125 million – topping up the sport’s bank account.

In contrast, the money paid to the teams is gobbled up to fuel their race campaigns and this is where F1’s commercial cycle begins again. Keeping F1 ticking over is a never-ending process."